Facts About G. Halsey Wickser, Loan Agent Uncovered

Table of ContentsSome Of G. Halsey Wickser, Loan AgentThe G. Halsey Wickser, Loan Agent PDFsG. Halsey Wickser, Loan Agent for BeginnersHow G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.G. Halsey Wickser, Loan Agent Can Be Fun For Everyone

The Support from a home mortgage broker does not end as soon as your home loan is safeguarded. They offer continuous aid, helping you with any type of questions or issues that emerge throughout the life of your lending - mortgage loan officer california. This follow-up support guarantees that you remain pleased with your mortgage and can make educated choices if your financial scenario modificationsSince they deal with multiple loan providers, brokers can discover a financing item that fits your unique monetary situation, also if you have been refused by a financial institution. This adaptability can be the trick to unlocking your imagine homeownership. Choosing to collaborate with a mortgage advisor can change your home-buying trip, making it smoother, faster, and extra financially valuable.

Discovering the ideal home for on your own and finding out your budget can be very stressful, time, and money-consuming - mortgage lenders in california. It asks a great deal from you, depleting your energy as this job can be a job. (https://www.wattpad.com/user) A person that works as an intermediary between a borrower an individual seeking a home mortgage or home finance and a loan provider normally a financial institution or lending institution

What Does G. Halsey Wickser, Loan Agent Do?

Their high degree of experience to the table, which can be crucial in helping you make informed choices and inevitably accomplish effective home funding. With rate of interest rates fluctuating and the ever-evolving market, having actually someone fully listened to its ongoings would make your mortgage-seeking process a lot easier, eliminating you from browsing the struggles of loading out documents and performing lots of research study.

This lets them use professional advice on the best time to safeguard a mortgage. Because of their experience, they also have actually established connections with a large network of lenders, varying from significant banks to customized mortgage service providers. This extensive network enables them to provide property buyers with various home loan alternatives. They can leverage their partnerships to find the ideal loan providers for their customers.

With their market knowledge and capability to bargain efficiently, home loan brokers play a crucial duty in securing the most effective mortgage bargains for their customers. By keeping partnerships with a varied network of lending institutions, mortgage brokers access to several home loan choices. Moreover, their increased experience, clarified above, can provide vital info.

G. Halsey Wickser, Loan Agent Fundamentals Explained

They possess the abilities and methods to convince loan providers to provide far better terms. This may consist of reduced rates of interest, lowered closing expenses, or even more adaptable settlement routines (mortgage broker in california). A well-prepared home loan broker can offer your application and economic account in a manner that attract loan providers, increasing your chances of an effective negotiation

This benefit is usually a pleasant shock for lots of homebuyers, as it permits them to take advantage of the proficiency and resources of a home mortgage broker without worrying regarding incurring additional expenses. When a customer secures a home loan through a broker, the loan provider makes up the broker with a commission. This compensation is a portion of the car loan quantity and is often based upon variables such as the interest rate and the type of financing.

Home loan brokers stand out in comprehending these differences and collaborating with lenders to find a home loan that suits each consumer's specific requirements. This personalized strategy can make all the distinction in your home-buying journey. By functioning carefully with you, your mortgage broker can make sure that your funding conditions straighten with your monetary goals and capacities.

Facts About G. Halsey Wickser, Loan Agent Uncovered

Tailored home loan solutions are the secret to an effective and sustainable homeownership experience, and mortgage brokers are the experts that can make it take place. Hiring a home loan broker to work along with you may result in rapid lending approvals. By utilizing their competence in this field, brokers can aid you avoid potential mistakes that often create delays in loan authorization, causing a quicker and extra efficient course to safeguarding your home financing.

When it comes to purchasing a home, browsing the world of home mortgages can be overwhelming. With so several options offered, it can be challenging to discover the best lending for your requirements. This is where a can be a valuable resource. Home mortgage brokers function as middlemans between you and potential loan providers, helping you find the very best home loan bargain customized to your particular scenario.

Brokers are skilled in the details of the home mortgage sector and can offer important insights that can assist you make informed choices. As opposed to being restricted to the home loan items used by a single lending institution, mortgage brokers have access to a large network of loan providers. This implies they can look around in your place to locate the ideal funding choices readily available, possibly conserving you time and money.

This accessibility to multiple lending institutions offers you a competitive benefit when it comes to securing a desirable mortgage. Searching for the appropriate home mortgage can be a time-consuming procedure. By collaborating with a mortgage broker, you can conserve time and initiative by letting them handle the study and paperwork included in searching for and safeguarding a lending.

G. Halsey Wickser, Loan Agent Fundamentals Explained

Unlike a small business loan officer who may be managing several clients, a home mortgage broker can provide you with personalized solution tailored to your individual requirements. They can take the time to comprehend your monetary situation and goals, providing personalized options that line up with your certain requirements. Mortgage brokers are skilled arbitrators who can aid you safeguard the very best possible terms on your loan.

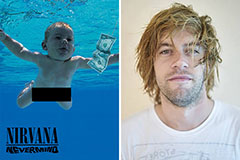

Spencer Elden Then & Now!

Spencer Elden Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!